Your Utah Local Home Lender.

As a Utah mortgage company, we provide personalized home financing with local expertise and competitive rates. From first-time buyers, Reverse Mortgages to refinancing, we offer quick approvals and guidance, ensuring your homeownership dreams come true.

Everyone has unique goals...

Home loans designed just for you

Home Purchasing

Home PurchasingHaving a great loan officer during the home-buying process ensures expert guidance and favorable loan terms for a stress-free experience.

Home Purchasing Home Refinancing

Home RefinancingRefinancing a home with a great loan officer can lead to reduced monthly payments, and potential savings in the long run.

Home Refinancing Reverse Mortgage

Reverse MortgageA great loan officer is essential for a reverse mortgage, ensuring thorough guidance, protection, and optimal financial outcomes.

Reverse MortgageStart your home buying journey today!

Having a great loan officer during the home-buying process ensures expert guidance and favorable loan terms for a stress-free experience.

Home Purchasing

Refinancing a home with a great loan officer can lead to reduced monthly payments, and potential savings in the long run.

Home Refinancing

A great loan officer is essential for a reverse mortgage, ensuring thorough guidance, protection, and optimal financial outcomes.

Reverse MortgageSimple Process

Constant Communication

Award winning lending team

Experience Excellence with Kenny Farshchian:

Utah's Premier Reverse Mortgage Loan Officer

As the esteemed loan officer, Kenny Farshchian, you can rest assured that you are working with the best in Utah. With his extensive knowledge and expertise in the lending industry, Kenny is dedicated to providing you with exceptional service and guidance throughout your loan journey. Specializing in reverse mortgages, Kenny is well-versed in the intricacies of the Utah market and understands the unique dynamics that come with it.

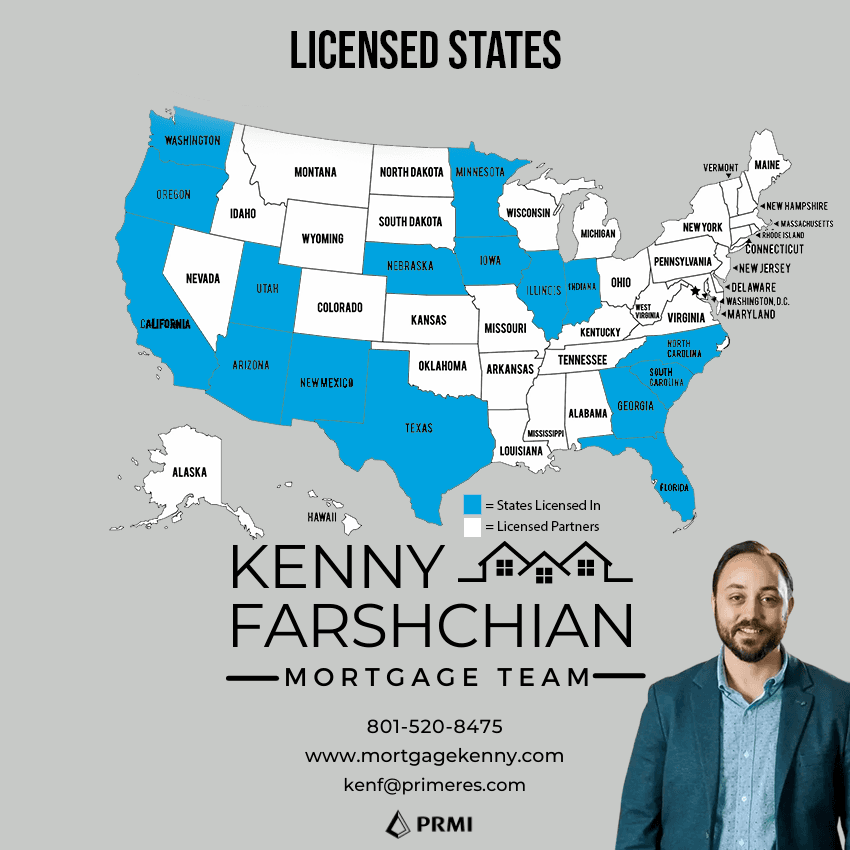

Not only does Kenny excel as a Utah loan officer, but he also extends his expertise to reverse mortgages in Texas and Florida. By staying up-to-date with the latest trends and regulations in these states, Kenny ensures that you receive comprehensive and tailored solutions, no matter where you are located. With a strong commitment to professionalism, attention to detail, and client satisfaction, Kenny strives to build lasting relationships based on trust and transparency. You can trust that Kenny Farshchian, as your dedicated reverse mortgage loan officer, will provide you with personalized guidance and the highest level of service throughout the loan process.

Securing Your Dreams: Primary Residential Mortgage, Inc. - Your Trusted Direct Mortgage Lenders in Utah, Led by Kenny Farshchian

At Primary Residential Mortgage, Inc., we are dedicated direct mortgage lenders in Utah, driven by our commitment to securing the best terms for your mortgage. Offering a comprehensive range of mortgage loan products, including Fannie Mae/Freddie Mac, Adjustable-Rate Mortgages (ARM), FHA loans, VA loans, HUD programs, USDA loans, Second Home, and Investment loans, we have the flexibility to find the perfect program that matches your unique needs and goals.

Led by the expertise of Kenny Farshchian, our team takes a personalized approach to mortgage lending. We differentiate ourselves by going the extra mile to work on your behalf, diligently finding the best mortgage solution tailored to your specific circumstances. As a nationwide lender, we have implemented robust layers of security and advanced technology, enabling our team to seamlessly operate remotely. This ensures that regardless of your location, we can provide exceptional care and service.

Don't wait any longer to achieve your homeownership dreams or refinance your existing mortgage. Contact us today to experience the dedication, expertise, and convenience that sets us apart as your trusted mortgage partner. Let us secure your dreams and make your homeownership aspirations a reality with Kenny Farshchian leading the way.

Nurturing Excellence: Kenny Farshchian's Compassionate Approach to Exceptional Mortgage Experiences

With a genuine passion for creating an exceptional mortgage experience, Kenny Farshchian, Utah's esteemed loan officer, goes above and beyond to ensure his clients receive nothing but the best. Specializing in reverse mortgages, Kenny understands the unique financial needs and goals of his clients in Utah and beyond. His extensive knowledge and expertise as a Utah mortgage lender allow him to provide tailored solutions that meet the specific requirements of each client.

Whether it's a reverse mortgage in Utah, Texas, or Florida, Kenny's commitment to excellence remains unwavering. He believes in building strong relationships with his clients, guided by trust and open communication. Kenny's dedication to creating anexceptional mortgage experience is evident in his attention to detail, personalized guidance, and proactive approach. He ensures that his clients are well-informed and supported throughout the entire process, offering a smooth and hassle-free experience.

Kenny's exceptional service extends beyond the transaction itself. As a reverse mortgage loan officer, he recognizes the significance of financial decisions and their impact on his clients' lives. With his expertise in the reverse mortgage markets of Utah, Texas, and Florida, Kenny provides comprehensive guidance that considers building the unique regulations and trends of each state. By focusing on long-lasting relationships and delivering unmatched service, Kenny Farshchian guarantees an exceptional mortgage experience that surpasses expectations.

As direct mortgage lenders based in Utah , Primary Residential Mortgage, Inc. is wholly dedicated to securing the most favorable terms for your mortgage. With a comprehensive range of mortgage loan products, including Fannie Mae / Freddie Mac, Adjustable-rate mortgages (ARM), FHA loans, VA loans, HUD programs, USDA loans, Second Home & Investment loans, we have the flexibility to cater to your specific needs and aspirations. Kenny and his team approach things uniquely, working on your behalf to identify the optimal program that aligns perfectly with your requirements and goals.

As a nationwide lender, we have tirelessly invested in implementing multiple layers of security and cutting-edge technology. These advancements enable our team to operate remotely, effectively serving you without requiring a physical presence in the various locations where we are licensed. Don't hesitate to reach out to us today and take the first step towards your mortgage journey!

Your Trusted Utah Loan Officer: Kenny Farshchian at Primary Residential Mortgage, Inc.

When it comes to financing your home, whether you're a first-time buyer or a seasoned homeowner in Utah, it's crucial to work with a trusted mortgage broker who will prioritize your education and consider all your loan options. That's where Kenny Farshchian at Primary Residential Mortgage, Inc. comes in. As a top-rate utah mortgage broker in Utah, Kenny takes pride in guiding clients through the process of obtaining a mortgage that meets their unique needs. With a wide range of loan products available for purchasing a home or refinancing, including options with or without cash-out, Kenny ensures that every client receives personalized attention and expert advice.

As a reliable utah mortgage broker in Utah, Kenny has access to a diverse portfolio of loan products, including adjustable-rate mortgages (ARM), FHA, VA, HUD programs, USDA, conventional, reverse mortgage and investment property loans. Recognizing that buying a home is a significant financial decision, Kenny is committed to finding the right loan for you and ensuring a smooth and memorable process. Whether you're a first-time homebuyer seeking guidance or have specific loan requirements, Kenny will walk you through the different options and help you choose the best one for your needs. With a thorough analysis of your credit, income, and debts, Kenny will determine the loan amount you qualify for.

Being a direct lender, Kenny and his team can expedite the loan closing process if needed. With a decade of experience in the industry, they have fine-tuned their lending process, resulting in fast mortgage approvals, competitive interest rates, and exceptional customer service. While their business spans nationwide, with a focus on Utah, Florida, and Texas, Kenny's reputation speaks for itself. Get in touch with Kenny Farshchian today to embark on your homeownership journey and experience the outstanding service that has made him a trusted name in the industry.

FAQs

How much mortgage can I afford with my salary?

To determine how much mortgage you can afford with your salary, it's important to consider various factors such as your income, expenses, debt obligations, and the prevailing interest rates. A commonly used guideline is the debt-to-income ratio (DTI), which indicates the portion of your monthly income that goes towards debt payments, including your mortgage.

What is a reverse mortgage?

A reverse mortgage is a financial product designed for homeowners who are typically aged 62 or older and have significant equity in their homes. Unlike a traditional mortgage where the borrower makes monthly payments to the lender, a reverse mortgage allows the homeowner to receive payments from the lender, effectively converting a portion of their home equity into cash.

What is a mortgage?

A mortgage is a type of loan that is used to finance the purchase of a property, such as a home or an investment property. It is a legal agreement between the borrower (the person purchasing the property) and the lender (usually a bank or financial institution) that allows the borrower to borrow a specific amount of money to buy the property.

How long does it take to get a mortgage?

The time it takes to get a mortgage can vary depending on several factors, including the complexity of your financial situation, the lender's process, and the efficiency of the parties involved. Here is a general timeline of the mortgage process:

1. Pre-approval

2. Loan application

3. Loan processing

4. Underwriting

5. Loan approval and closing

What is mortgage insurance?

Mortgage insurance is a type of insurance that protects the lender in case the borrower defaults on their mortgage payments. It is typically required when the borrower makes a down payment of less than 20% of the home's purchase price. Mortgage insurance allows lenders to offer loans with a lower down payment while mitigating their risk.

How do I get a mortgage?

To get a mortgage, you generally need to follow these steps:

1. Determine your financial readiness

2. Research and compare lenders

3. Get pre-approved

4. Gather necessary documents

5. Complete the mortgage application

6. Loan processing and underwriting

8. Loan approval and close the loan

It's important to note that the mortgage process can vary among lenders, and the timeline can be influenced by factors such as the complexity of your application, responsiveness in providing documentation, and the lender's workload. Working closely with your chosen lender and keeping communication open will help streamline the process. Regenerate response